what is a levy on personal property

Where does Internal Revenue Service IRS authority to levy originate. Levy basically means that the officer takes the property such as your baseball card collection or instructs the holder of the property like your bank to turn it over to the officer.

What Is Personal Property Tax Property Tax Personal Property Tax Guide

An IRS levy permits the legal seizure of your property to satisfy a tax debt.

. Levies are different from liens. This includes wage garnishments bank account levies judgment liens on real property and yes even the seizure of personal property. In some states 1 one personal vehicle may be excluded as necessary to the livelihood of the person against whom the levy has been made.

Aside from personal property items and your home other types of property can be exempt from execution and levy as well. A levy may be placed on real property or tangible and intangible personal property. The rate jumps to 1 ten days after the IRS issues a final notice of intent to levy or seize property.

This can be a tax levy or some other form of judgment. After taking your property the sheriff or marshal sells it at a public auction and. Each taxing district has its own levy and levy rate.

A property tax or millage rate is an ad valorem tax on the value of a property. Is an order against the property defined in the order. A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes the property to satisfy the tax debt.

Examples of typical property subject to levy include. A levy is a legal seizure of your property to satisfy a tax debt. The tax is levied by the governing authority of the jurisdiction in which the property is located.

Levy on Personal Property. So far Levys legacy is limited to structures in New York City. In many cases this property is a motor vehicle or piece of equipment belonging to the defendant.

Court-issued document that begins the transfer of assets. Personal Property Levies as a Judgment Collection Tool. A levy is usually obtained with a writ of execution and allows creditors to seize tangible property like cars or homes or intangible property such as wages bank accounts or investments.

If you receive an IRS bill titled Final Notice of Intent to Levy and Notice of Your Right to A Hearing contact us. After that the creditor should try to levy tangible personal property. A levy is when a creditor is allowed to take and sell your personal property.

Money in a deposit account personal property owned by the judgment debtor in the judgment debtors possession personal property owned by the judgment debtor in a third parties possession a vehicle or vessel owned by the judgment debtor the debtors interest in personal property of a decedents estate and. Which is an example of a property tax. A property tax levy rate is the amount of money for every 1000 of assessed property value necessary to generate the levy amount.

This may vary by state. State law determines how long the judgment remains valid and enforceable. Anything you own that can be moved like vehicles or other valuable items Real property.

It can garnish wages take money in your bank or other financial account seize and sell your vehicle s real estate and other personal property. A property tax levy refers to an amount of money that is collected or levied against taxable property. However the penalty is only 025 for each month or part of a.

Anything you own that cannot be moved like your home land or other buildings. A personal property levy allows a creditor to obtain possession of much of the debtors property in California eg equipment inventory vehicles cash in cash registers excluding real property and property held by. Depending on the situation it can on occasion be cheaper easier and quicker to levy personal property and in particular intangible personal property.

A levy is a strategy creditors typically use only after they have given up on other ways to collect from you. For example most states do not allow creditors to execute and levy on Social Security or veteran benefits unemployment or workers compensation unmatured life insurance policies or the dividend and payments pursuant to stock bonuses. The property subjects and objects subject to property tax are mostly specified in chapter 203 which deals with property tax assessment.

Presumably by that point you would already know creditors are taking legal action and trying to get money from you. An IRS levy permits the legal seizure of your property to satisfy a tax debt. Once a creditor has a judgment they have additional ways of getting you to pay them.

The municipal tax authority sets a percentage rate for imposing taxes called a levy rate which is then calculated against the assessed value of each homeowners property ad valorem literally. Under that statute municipalities can assess levy and collect taxes for general or special purposes on all property subjects or objects that may be lawfully taxed. Levies are a more aggressive debt collection method but it can take more time and resources to collect on a debt than a lien.

A collection enforcement tool that creditors use to collect on a debt. When a Levy on Personal Property is requested the Execution empowers Deputy Sheriffs to seize the personal property of the defendant. Examples include bank accounts wages accounts receivable etc.

A Business Tangible Personal Property Tax T Ppl Is A Levy On Business Equipment Real Estate Plant And Equipment Software Personal Property Property Person

All About Gst Composition Scheme 1 3 Turnover Limit Input Credit Returns Faq Composition Schemes Goods And Service Tax

How South African Non Income Taxes Are Paid Income Tax Income Indirect Tax

Successful Property Managers Advice And Winning Strategies From Industry Leaders Vol 2 Property Management Management Strategies

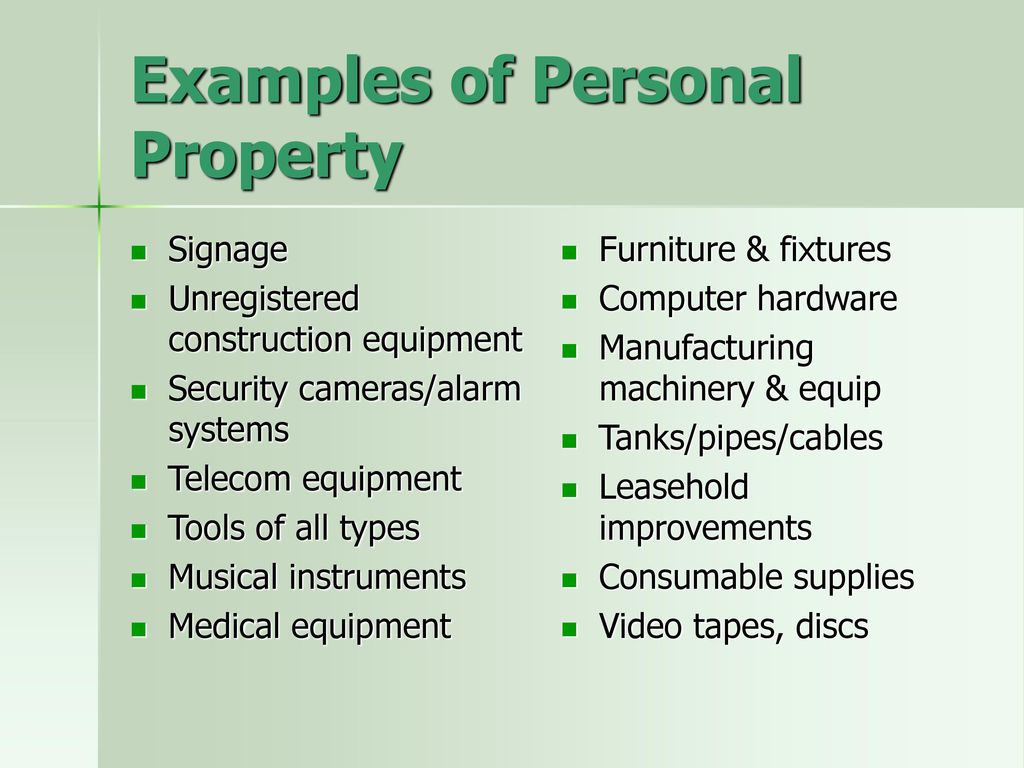

Caao Aat Personal Property Workshop Ppt Download

All About Gst Composition Scheme 3 3 Turnover Limit Input Credit Returns Faq Composition State Tax Schemes

Country House By Diegoreales On Deviantart Modern Architecture House Architecture Architecture House

Pin By Balboa On Personal Finance Personal Finance Good Advice Frugal

Advertisement Ioi Properties Group Iskandar Malaysia Marina Cove The Platino Cove Advertising Johor

Caao Aat Personal Property Workshop Ppt Download

Download Policy Brief Template 40 Brief Policies Ms Word

Free 4 Subordination Agreement Forms In Pdf Ms Word For Lottery Syndicate Agreement Template Word Great Cre Lottery Invoice Template Word Being A Landlord

2016 Volkswagen Passat Has New Tech New Looks And Bad Timing Volkswagen Passat Volkswagen Best Cars For Teens

Ads Flyer On Behance Brochure Design Layout Layout Layout Design

Pin By The Project Artist On Understanding Entrepreneurship Tax Haven Old Apartments Understanding

Mobile App Inspiration Mobile App Mobile App Design

Best Tax Attorney In Dallas Tax Attorney Tax Lawyer Tax Refund

Pledge Of Personal Property Template Google Docs Word Apple Pages Template Net Job Description Template Job Description Word Doc